When people search for “John Cerasani net worth,” they’re often curious about the story behind the number rather than the figure itself. His journey isn’t simply about accumulating wealth; it’s about building businesses, taking risks, making timely decisions and continuing to evolve. From growing up in suburban Chicago to becoming an entrepreneur, author and investor — his path shows how ambition paired with strategy can create long-term financial growth. This article takes an in-depth look at how his net worth expanded gradually and deliberately over the years.

- Early Life and Educational Background

- His Start in the Business World

- Launching His Own Company and Scaling

- Selling His Company and Its Impact on Wealth

- Expanding Into Venture Capital and Investments

- Media Presence, Books and Personal Branding

- Current Estimated Net Worth

- Key Factors Behind His Wealth Growth

- Lessons Readers Can Learn From His Financial Journey

- Conclusion

- FAQs

Early Life and Educational Background

John Cerasani was raised in the Chicago suburbs, where sports played a major role in his early development. Football, in particular, shaped his discipline and determination. Earning a college football scholarship — and later attending reputable universities — gave him structure and a strong sense of accountability. His academic and athletic experience helped him build a mindset driven by performance, teamwork and consistency.

This foundation played a crucial role in his later business life. Many of the qualities he cultivated in sports — resilience, leadership and handling pressure — translated naturally into entrepreneurship. Before he ever launched a company, he had already built the habits that would fuel years of professional growth.

His Start in the Business World

After completing his studies, John entered the insurance and benefits industry, beginning his career in corporate sales. This phase of his life gave him hands-on exposure to client relationships, negotiations and operational strategy. He learned the inner workings of the insurance market, including how companies manage risk, structure policies and build recurring revenue models.

In his early twenties, he dipped into entrepreneurship with a nightlife promotions venture. Although unrelated to his later businesses, this experience strengthened his confidence as a business builder. Eventually, he founded his own insurance brokerage firm — a move that marked the true beginning of his financial growth trajectory.

By recognizing early how powerful the insurance industry could be when scaled correctly, he positioned himself for a long-term financial advantage.

Launching His Own Company and Scaling

Starting his insurance brokerage laid the groundwork for the first major phase of John Cerasani’s net worth. As his company grew, he secured larger accounts, expanded operations and built a reputation for delivering value to clients. By improving sales processes and strengthening his internal team, the company became more competitive and more profitable.

Scaling a business is often the hardest stage, but he managed it by focusing on sustainable growth. Instead of chasing quick wins, he concentrated on long-term client relationships and steady expansion. Over the years, his company became a strong asset — not just in terms of revenue but also valuation. That valuation would later become a crucial part of his wealth story.

When a business reaches this level of maturity, it becomes more than a source of income. It becomes a sellable, valuable piece of equity — and that opened the door to the next major financial milestone in his life.

Selling His Company and Its Impact on Wealth

One of the biggest accelerators of John Cerasani net worth was his decision to sell his insurance company. While the exact financial details aren’t publicly documented, what’s clear is that the sale provided him with substantial liquidity. It transformed years of hard work and business building into tangible capital he could use to pursue new ventures.

This moment represents a classic entrepreneur’s transition from operator to investor. Selling a business at the right time can multiply a person’s financial position dramatically. In John’s case, the sale:

- Converted business equity into liquid wealth

- Created new investment opportunities

- Provided the freedom to shift into a broader range of professional activities

This liquidity event served as the launching pad for the next stage of his wealth expansion — venture investing.

Expanding Into Venture Capital and Investments

After exiting his insurance business, John founded an investment firm and entered the world of venture capital. This transition significantly increased his potential earning power. Instead of relying on one business, he now invested in multiple companies across various sectors, including technology, fitness, software, hospitality and consumer products.

This stage of his career is a major contributor to his growing net worth because:

- Venture capital offers high-upside opportunities

- Diversification reduces risk compared to relying on a single business

- His business experience allowed him to evaluate companies more wisely

- Equity investments grow in value as companies scale

Some of the companies he invested in gained traction and visibility, further increasing the value of his portfolio. He also took on advisory and board roles, allowing him to guide companies strategically while benefiting from equity positions.

Through smart investing and business insight, this phase pushed John Cerasani’s net worth to new heights — and continues to influence it today.

Media Presence, Books and Personal Branding

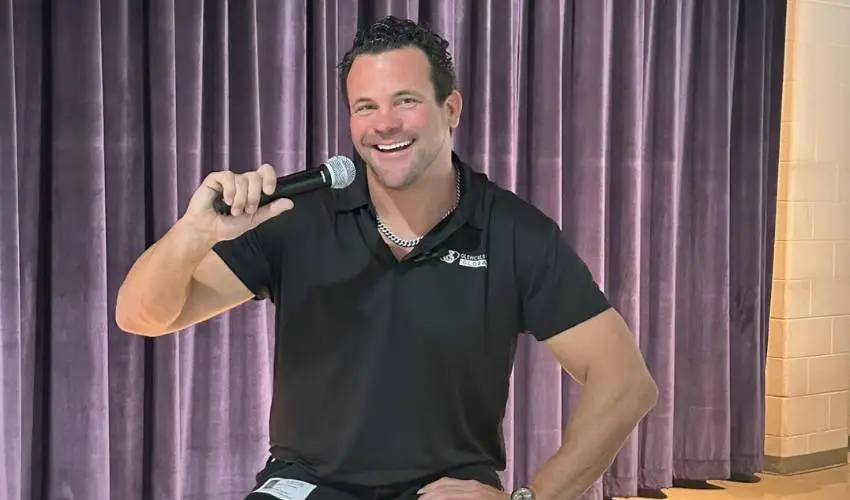

Beyond business, John built a strong personal brand through writing, podcasting and public appearances. He authored books, shared entrepreneurial insights and amplified his voice through different media channels.

This side of his career plays an underrated but important role in his net worth:

- Books generate royalties and help establish authority

- Podcasts and speaking engagements expand his audience

- Public presence increases trust and visibility

- A strong brand attracts better investment opportunities

In the modern business landscape, personal branding is almost as important as the businesses themselves. The credibility he built through media helped widen his opportunities and enhanced the value of his ventures.

Current Estimated Net Worth

Although the specific number varies across sources, most public estimates place John Cerasani net worth somewhere between the mid-seven-figure to the mid-eight-figure range. Some estimate around $6 million, while others place him between $25 million and $50 million. A few place him even higher due to his extensive investment portfolio.

Why the variation?

- Most of his investments are in private companies

- Private equity valuations fluctuate

- Business holdings may be illiquid

- Media and brand revenue can shift year to year

- Real estate, venture holdings and other assets make exact calculation difficult

Based on available insights and the size of his ventures, a reasonable midpoint estimate is likely between $30 million and $50 million. This represents the combination of his business sale, ongoing investments, real estate and brand-related income streams.

Key Factors Behind His Wealth Growth

Several core principles define how John Cerasani net worth increased over the years:

Entrepreneurial foundation

He built a business from the ground up, giving him firsthand knowledge of operations, sales and growth.

Strategic scaling

Instead of focusing on quick revenue, he built long-term value — which allowed the business to be sold for a meaningful return.

Reinvestment and diversification

He reinvested into multiple ventures, reducing risk and increasing long-term upside potential.

Strong personal brand

His public presence strengthened his credibility, networks and investment opportunities.

Consistent opportunity recognition

He didn’t stay tied to one industry. Instead, he followed opportunities where growth potential was highest.

Patience and long-game thinking

Most of his wealth came from years of strategy, discipline and timing — not shortcuts.

Lessons Readers Can Learn From His Financial Journey

While John Cerasani’s journey is unique, there are valuable takeaways for anyone building their own financial path:

- Invest in your skills early — they compound over time.

- Focus on building something that can scale, not just generate income.

- Develop an exit strategy early, even if you don’t plan to sell soon.

- Don’t rely on one income stream when diversification is possible.

- Build a personal brand — credibility creates opportunity.

- Look for industries where your experience gives you an advantage.

- Treat business and investments as long-term commitments.

These lessons reflect the mindset that helped shape his financial success.

Conclusion

The growth of John Cerasani net worth didn’t happen overnight. It was the result of years of building, selling, reinvesting and evolving. From his early days in sports to launching his insurance company, exiting it and then becoming a full-time investor, each stage built on the last. Today, his wealth reflects not just financial decisions, but discipline, resilience, networking and strategic vision.

His story demonstrates that lasting wealth often comes from calculated moves — not luck. And for anyone looking to follow a similar path, the blueprint is clear: build value, seize opportunity, diversify and never stop evolving.

FAQs

What is John Cerasani’s net worth?

John Cerasani’s net worth is commonly estimated in the multi-million range. Public sources place it anywhere between the high seven figures to the mid-eight figures, depending on the value of his investments and private business holdings.

How did John Cerasani make his money?

He built his wealth by launching and scaling an insurance brokerage, selling the company, and then reinvesting the proceeds into startups and early-stage companies. His media work, books, and personal brand also contribute.

What businesses is John Cerasani involved in today?

Today, he focuses largely on venture capital and angel investing through his investment firm. He also participates in advisory roles, podcasts, and public speaking connected to entrepreneurship and business growth.

Did his business exit significantly increase his net worth?

Yes. Selling his insurance company created the major financial turning point that allowed him to move from operator to investor. This liquidity event helped accelerate the wealth he later built through multiple investments.

You May Also Read: Anok Yai Net Worth in 2025: What Her Success Reveals About the Industry